I did a little research into this not too long ago due to the Costco card discontinuing travel benefits. I ended up getting the Chase Sapphire Reserve card. There are two types of benefits that may or may not be covered by the same insurer - trip cancellation/interruption and emergency medical expense/evacuation.

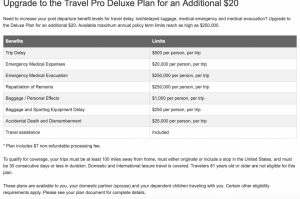

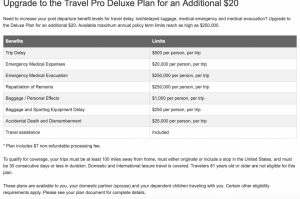

Many credit cards include trip cancellation/interruption benefits, but maybe only for transportation like airfare and rail. The Sapphire Reserve also covers non-refundable lodging, car rentals, and tours.

My health insurance covers ambulance services, to include air ambulance, if it is medically necessary and the transportation is to the nearest hospital. It does not cover any further transportation to return home. The Sapphire Reserve coverage is secondary and would pay whatever my health insurance doesn’t pay, up to $100K. It pays for transportation home after the hospital visit and also covers flying a relative to you if you must stay in the hospital for longer than a week. I’d like to think between my health insurance and the Sapphire Reserve, I’m good for emergency medical.

So far I haven’t had to use any of these benefits. I do get specific trip insurance for cruises though. The medical coverage is primary so we don’t have to go through our own health insurance first, which I didn’t know ahead of time. It also has missed port coverage. We used both on our last cruise and the reimbursement nearly paid for the insurance cost.